For many businesses the last three years have been particularly challenging. Brexit, the COVID-19 pandemic, labour shortages, rising energy costs, serious supply chain disruption and now a return to more normal levels of interest rates.

Owners and managers of companies are living through profoundly challenging times. Whatever the strength of your balance sheet, market position and attractiveness as an employer, none of us know when or what the next black swan event will be or how quickly it might impact on a firm’s business model.

Businesses get into difficulty because of a lack of liquidity (cash). Successful businesses have employees to pay, debt to service, working capital and assets to finance, landlords to pay and other fixed costs like insurance, rates and taxes.

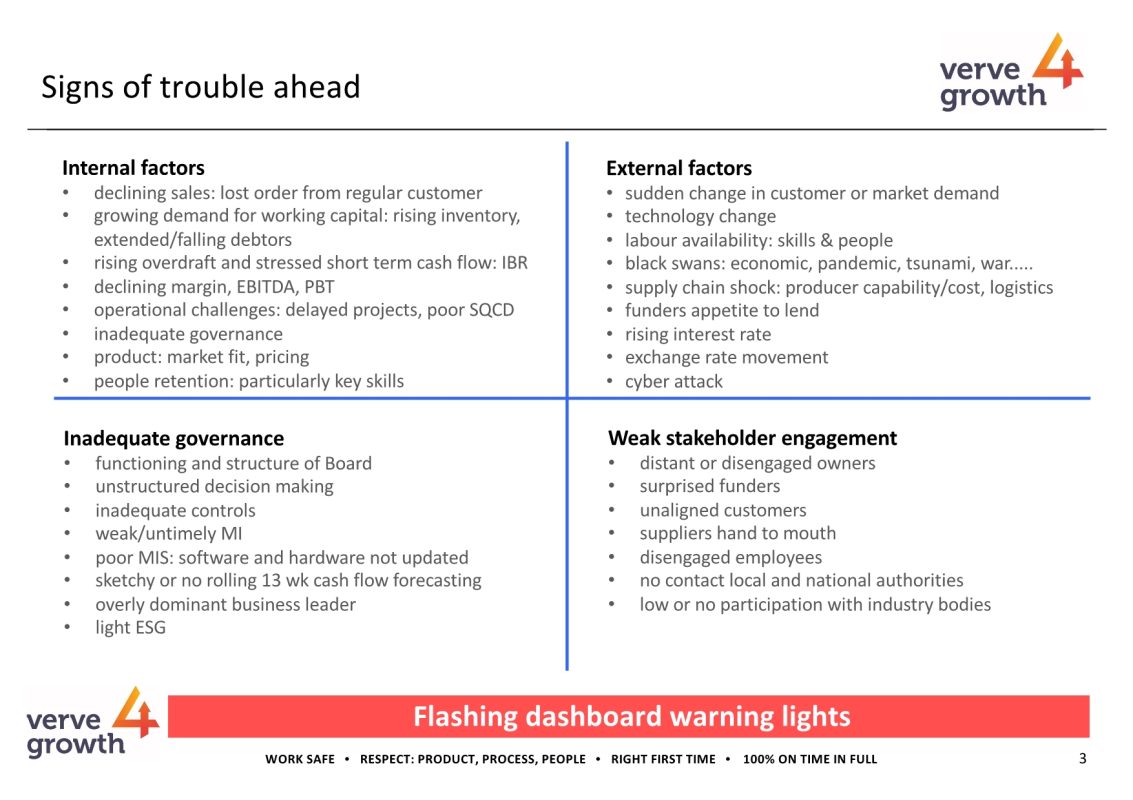

All too often businesses fail to spot the signs of trouble ahead. A lost order from a regular customer, below par operational outcomes for quality, delivery and productivity, delays to new projects, the resignation of key employees, a competitor going out of business, suppliers being late or unable to fulfil requirements, and declining or negative cash flow.

Of course, not everything shows up on the radar screen at once. Much that does may seem familiar or be explainable. It is human nature to be optimistic and so miss the accumulated signs of changes over time. And it is likely there will be management debate as to whether what is showing up is a trend or just a blip.

Stages of business growth and decline

Businesses have lifecycles: creation, survival, take off, success, maturity… and at any stage the business’s trajectory can take a downward trend. At these moments there is a finite period of time in which to act and regain control.

In today’s world, events happen faster. What last year looked successful, can rapidly be undermined. How many industries are being constrained by chip shortages or Putin’s energy cost hikes? How many SMEs are viable at one to two percent interest rates but will become ‘stressed’ servicing debt at more normal interest rates?

Business failures are inevitable in a healthy economy. But many challenged businesses can survive and thrive with the right external help and support.

Outcomes often depend on management’s willingness to recognise that the business is in trouble. Events today move quickly and a business in trouble can very rapidly progress down the decline curve towards the medical equivalent of intensive care.

How does a turnaround director deliver a better outcome?

Clear-eyed assessment: The starting point is a clear-eyed assessment of the business’s financial, commercial, operational and strategic health. What are the challenges? Is there a pathway to success? Are stakeholders aware, engaged and on board? Are management and key employees up for the hard yards ahead?

Energise for action: Once the immediate challenges are identified, it is necessary to stabilise the finances and core activities. Often that can mean agreeing with the bank additional or alternative funding arrangements, pushing through price increases and eliminating all non-business critical spend. This is about energising the business, working at pace to change the trajectory whilst building stakeholder confidence and support.

Outline business plan: As stability returns, the task then is to map out a way forward. Stakeholder engagement is critical when developing a plan for the business. If the current owners have no appetite or access to resources to fund the plan, then a sale may have to be considered. In any event, the business plan needs to be sufficiently detailed to support going to the owners or the markets for funding support.

Score the goals: The final task, once all are agreed on the plan, is to make it happen. The turnaround director needs to lead the team in the execution of the plan. That will often mean taking some hard decisions about people, products, customers and processes. The key is empowering management and employees to deliver the new plan. And making sure that stakeholders are kept up to date on progress.

Leading turnarounds is a skill. The challenges are numerous, and the rewards finite; delivering a better outcome than might have been achieved before engagement. That could be jobs saved, a business sold, improved profitability or cash generated. It is great to give a business another chance and hopefully a better trajectory.

My key message to owners and boards is ask for help.

Time is the enemy. It takes time to plan and execute a better outcome.

So, if your business trajectory is cause for concern, reach out.

This article was originally published in The Manufacturer, December 2022.